How to Pay Off Your Personal Loan Quickly?

31 Mar 2022

Table of Content

-

Tips for paying off personal loan early

-

Review the debt you owe

-

Understand your repayment capability

-

Try to make an extra payment

-

Round up the EMI amount

-

Use a bonus to make a larger payment

-

Consider doing a loan balance transfer

-

What is the pre-payment penalty applied to personal loan pre-closure?

-

What are the documents required for loan pre-closure?

-

Documents to be submitted to the lender

-

Documents to be collected from the lender

-

Key Takeaways

A personal loan can prove to be a boon in helping you meet planned and unplanned expenses. Many borrowers often prefer personal loans over other types of loans as these loans are apt for all purposes. Whether you need to fund your home renovation or take that long-overdue family vacation, a personal loan can help fund a variety of expenses.

Personal loans can be availed at attractive interest rates and usually require minimal documentation. However, before taking the loan, you also need to think about repayment. It is always better to pay off your loan faster as doing so helps you save on interest.

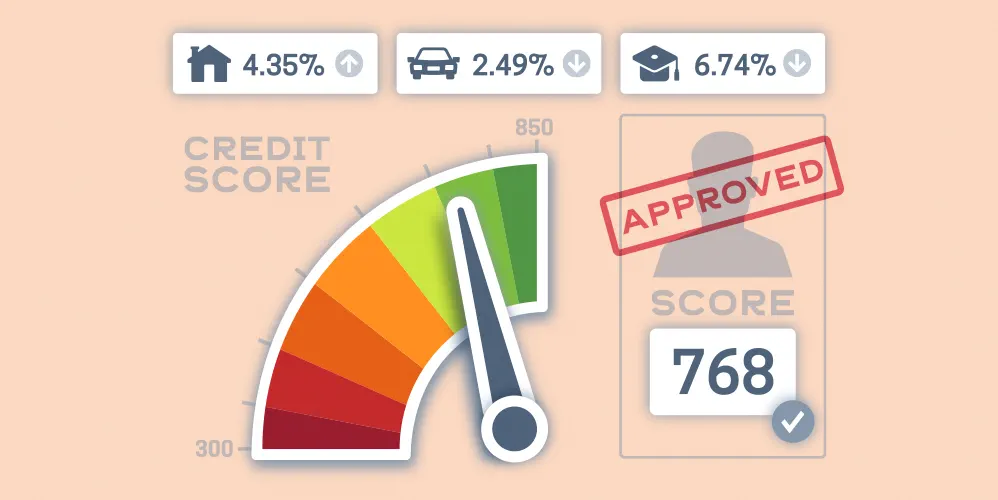

Paying off your personal loan as soon as possible can positively impact your credit score and eligibility for further loan requests. It also puts you in a better position financially. Let’s understand how to pay off a personal loan quickly.

Tips for paying off personal loan early

Review the debt you owe

Before you start planning how to repay your loan faster, it is crucial that you first know the exact amount you owe. Examine all the payments you have made till date and the ones that are due. Then, make a note of all the other payments you have on your list every month, like home loan EMIs, insurance premiums, household bills, and credit card balances. Only when you have a clear understanding of your finances, can you create a repayment strategy that will work. Knowing how much you owe will help you understand the maximum amount that you can put towards your personal loan payments each month.

Understand your repayment capability

Once you have a clear idea of the amount of money you owe, you need to evaluate your repayment capacity. Analyse your current income and financial obligations. Try and estimate how much can you contribute each month towards your loan repayment. Find out if there is a way by which you can increase your repayment capacity. You may want to consider cutting down on monthly expenses or working on getting an additional source of income. Never overestimate your ability to repay your personal loan as you may need to keep spare funds in your savings account for emergencies.

Try to make an extra payment

A simple way of ensuring that you pay your personal loan faster is by making an extra payment every year. Paying one additional EMI each year will help you pay off your loans more quickly. With each payment, the principal amount and interest payable considerably reduces and you come closer to ending your debt.

If you feel an extra EMI will be heavy on your pocket, you can split the amount into smaller portions. For example, if you pay an EMI of INR 6,000 per month. You can divide the given sum by 12 months and add INR 500 to your monthly EMI. So technically, you are paying the usual EMI amount plus an additional sum each month.

Round up the EMI amount

Another great way of paying off your personal loan early is by rounding up the EMI amount. For many people, the EMI amount might not be a whole number but rather a decimal. Generally, paying a round figure amount often helps in settling a loan early.

Now, you may think that paying a rounded-up amount won't make that much of a difference to your loan repayment. However, that is not always true. Even the smallest of extra contributions will help you repay your loan faster. For instance, if your EMI is INR 4375.30, opt to pay INR 4500 instead. The additional contribution of 120 INR also makes a huge difference if added up over the course of a few months.

Use a bonus to make a larger payment

Try using any salary bonus or work incentives to pay off your personal loan. You may sometimes feel that you are losing out on enjoying the bonus amount that you have worked so hard for. However, you are actually helping yourself reduce your debt more quickly. So, try to use any surplus cash that you get to pay off your loan.

Consider doing a loan balance transfer

The interest rate levied plays a huge role in determining how much a loan will cost us. Now, you may have had to accept a loan with a higher interest rate in the past due to lack of alternative options. With time, if you find a lender who is offering you a loan at a lower interest rate and on better repayment terms, you can choose to switch your loan over to them. This is called a loan balance transfer. With a loan balance transfer, you may save money with better interest rates and work out better, more affordable repayment terms.

What is the pre-payment penalty applied to personal loan pre-closure?

Most banks charge a pre-payment penalty if you close your loan earlier than expected. The penalty amount is calculated as a percentage based on either the existing loan balance or the interest the lender will lose due to pre-closure. Generally, the pre-payment penalty is somewhere between 2% to 5% of your loan amount. The exact charge can vary between lenders.

Do remember that all details about the pre-payment penalty and conditions applied to this penalty are mentioned in your loan agreement in detail. Make sure you read the agreement thoroughly before signing it.

There are two ways by which you can try to avoid paying the pre-payment penalty. First, look for a lender that does not charge a penalty for pre-closure. Second, opt for a lender that allows you to pay off your loan penalty-free after a specific point in the tenure.

What are the documents required for loan pre-closure?

There are a few documents that need to be exchanged between a lender and borrower in case of loan pre-closure. Ensure that you have all these documents as they are proof that you have repaid your loan.

Documents to be submitted to the lender:

- KYC documents

- All relevant loan documents

- Bank statements reflecting EMI payments made to date.

- Pre-payment statement

Documents to be collected from the lender:

- Receipt of pre-closer payments

- No objection certificate (NOC) to close the personal loan

- Personal loan closure certificate

- Payment due certificate

You may want to ask your lender for an exact list of the documents needed as per their process.

Key Takeaways

Here’s a quick recap of what we learnt today:

- Review and understand your capacity for making extra payments on your personal loan

- Try to get extra income to put towards your personal loan payments

- Look for lenders who do not charge a pre-payment penalty if you close your loan early or who waive this penalty after a certain amount of time

Popular Articles

Tag Clouds

Related Articles

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

How to Get a Personal Loan Without a Salary Slip in India?

Personal loans can prove helpful in consolidating your existing debts and helping you meet financial emergencies. You can even procure a personal loan to finance special occasions such as a marriage ceremony or an anniversary holiday. It is one of the

most popular types of loans available in the market today.

Advantages of Bank of Baroda Two-Wheeler Loan

Motorcycles are the primary means of transportation in a vast majority of Indian households. Two wheelers also make it easier to manoeuver India’s busy streets very quickly. Hence, India is among the top 4 largest motorcycles markets across the world

Leave a Comment

Thanks for submitting your details.